How do we keep this site running? This post may contain affiliate links, for which we may receive a referral fee. The cost is the same to you and any compensation we may receive does not affect our reviews or rankings. Thanks!

Quicken Deluxe 2018 Software for Windows and Mac. Quicken Deluxe 2018 Windows & Mac DVD Windows. Discount 16% Over 70 bought $49.99 $41.99. To ensure the quality of reviews, all reviews are screened for spam and content that may be offensive to other people. Quicken Mac 2018 is a glorious flaming waste of time if you want a semblance of tracking investments. I have been using Quicken Mac since 2004. I have diligently been forced into upgrading purely because mac has improved with time and no longer can run older versions of Quicken. Overall, we think that Quicken for Mac 2018 is a good improvement, but is still lacking some key features that can be found online for free, using services like Personal Capital or Mint.

Starting with this year’s release, Quicken 2018, Quicken has changed their pricing structure and the various Quicken editions. The price is more expensive than people have paid in the past and payment is based on a yearly subscription. Basically, you now pay a yearly fee for the rights to use the Quicken program.

In case you are looking for an alternative to Quicken, I will first mention the two top Quicken replacements.

After that, I’ll explain the new Quicken editions for 2018, then I’ll talk more about the pricing changes.

Alternatives to Quicken

Understandably, some people are frustrated with Quicken’s change in pricing. For people who don’t normally upgrade Quicken every year, the new pricing can be quite a bit more expensive. Before you take the leap into a Quicken subscription, you may consider trying out one of these two alternatives.

The first alternative is completely free and the other has a free 30-day trial.

1. Personal Capital

My first recommendation is Personal Capital. This program is completely free and is an outstanding product. It’s easy to set up, easy to use, and lets you keep track of all your accounts in one place. For anyone with investments, it has especially good investment tools that are better than those that come with Quicken. Try Personal Capital for free.

2. Moneyspire

My second recommendation is Moneyspire. This program is very similar to Quicken, it supports both Windows and Mac, and comes with a free 30-day trial. You can even import your Quicken data into Moneyspire so you don’t lose any history. This is the best desktop personal financial management program next to Quicken and a great alternative if you are looking for a change. Try Moneyspire free for 30 days.

New Quicken Editions for 2018

There are now three editions for Mac users and four editions for Windows users.

Mac users can rejoice because Quicken Starter, Deluxe, and Premier work on both Windows and Mac. Formerly, there was only one limited version of Quicken for Mac, but now Mac users get the same versions of Quicken that are available to Windows users, along with all the great features that have been missing from previous Mac editions.

The former Quicken Rental Property Manager and Quicken Home and Business editions have been combined into the new Quicken Home, Business, and Rental Property. This new edition includes all the features of the former Quicken Rental Property Manager and the former Quicken Home & Business. At this time, Quicken Home, Business, and Rental Property works on Windows computers.

The Windows and Mac versions are nearly identical, with very minor differences. Premier editions and above come with Quicken Bill Pay included for free, a $119/year value. Premier and above also come with free priority customer support.

New Quicken Price Structure (Membership Subscription)

Beginning this year, Quicken will now be a membership subscription. Under this new pricing system, Quicken users pay for a 12 or 24 month membership subscription to the software instead of paying for an annual upgrade. This is a good thing. Let me explain why.

First of all, in previous years, many Quicken features would stop working at a pre-determined date, regardless of when a user purchased and installed the software. Under the new subscription model, a user gets a full 12 or 24 months of full Quicken functionality beginning when the user installs and activates the software. This new subscription system is more fair to users because you now get the full term of Quicken usage that you pay for, regardless of when you purchase or install your Quicken software.

A second advantage of the new subscription system is instant access to new features. Under this new system, as soon as Quicken releases an upgrade, enhancement, or new feature, all users get it right away. Under the old system, you had to wait until a new version was released in the fall before getting access to new features. Now, new features will be added and installed continuously, giving you the latest and greatest version of Quicken no matter what time of year you purchase it.

The new subscription system also includes 5 GB of free online secure backup storage in partnership with Dropbox. This lets users backup and restore Quicken data from Dropbox without having to pay for an additional storage fee.

Quicken Premier and Quicken Home, Business, and Rental Property users will receive Quicken Bill Pay included for free. This Bill Pay feature was previously a paid addition to Quicken, but is now included in the membership subscription price. This is a $119/year value that’s included free. This alone makes Premier worth the price. You can pay any business or individual in the U.S., making is super easy to pay all your bills on time from one place.

Lastly, Quicken is the best personal financial management product available. I want to see it get better and continue improving. The only way that can happen is if Quicken receives enough revenue to pay for more developers and to show a profit. This change to a membership subscription model will help Quicken receive a more consistent revenue stream to keep the company profitable and working on improving our favorite money management program.

This all comes at a cost of only $2-$4 per month (check out current prices). If you don’t think Quicken is worth this price, I would suggest you try one of the Quicken alternatives listed at the beginning of this article.

Now for some big questions people are asking:

Is Quicken now an online program?

No, Quicken is still a desktop program that you install on your computer. The new subscription membership only changes the way you pay for Quicken, but the program itself is still the same (with updates and new features). Your Quicken data is still saved on your own computer, not in the Cloud. Quicken does come with free Dropbox space, but you do not have to backup your Quicken data to Dropbox unless you choose to do so.

What happens if your subscription expires or you don’t renew? Do you lose access to Quicken?

No, you don’t lose access to Quicken. You’ll still be able to use Quicken to view all your data, enter transactions manually, and view/print reports. Online-based features will be turned off, meaning you won’t be able to download transactions directly from your bank or use Bill Pay, but you will still be able to enter transactions manually and access all your data. If you decide to renew your subscription, all the online-based features will be turned back on. (Note that this does not apply to the Quicken Starter edition. If you are using Quicken Starter, all your data will become read-only when your subscription expires.)

If I install Quicken on more than one computer, do I have to purchase more than one subscription?

With Quicken 2018, you are allowed to install Quicken on an unlimited number of computers. You can even install it on a PC and on a Mac. You only need to buy one subscription. The subscription is linked to your Quicken ID. As long as you are using the same Quicken ID on each device, you can use Quicken on as many devices as you would like.

Where should you go to get a membership subscription to Quicken 2018?

There are a few different options, and as always, I’ll try to point you to the best deals.

- Least Favorite Option: If you want to pay full price and get just a one-year (12 month) subscription, you can go directly to Quicken.com. There you can purchase a 12-month membership to any of the Quicken editions at the full retail price. This is the most expensive way to purchase Quicken.

- Better Option: If you would like to save money (and who doesn’t), I would recommend going to an online retailer. Most online retailers are selling 2-year (24 month) subscriptions to Quicken at a significant discount to paying for a one-year subscription twice.

We list the current best prices from around the web on our price comparison chart. - Best Option: If you want to save even more money, I recommend buying your subscription at Amazon. Amazon has an exclusive deal with Quicken to offer a 27-month subscription for the price of 24 months. So you essentially get an extra 3 months on your subscription for free. There are several other advantages to purchasing Quicken on Amazon:

Amazon Exclusive Subscription Advantages

- 27 months for the price of 24 months (three months free)

- 15 GB of additional free online storage for Quicken backups with Dropbox (in addition to the standard 5 GB that now comes with Quicken)

- Free Premium support with unlimited priority access official Quicken Customer Care ($49.99/year value)

New features for Quicken 2018

Quicken 2018 New Features for Windows

- Automatic bill tracking with 11,000+ billers supported

- More custom report layout options and export to Excel

- 5GB free secure online backup with Dropbox

- Move and archive investments (Deluxe and up)

- Better investment performance analysis (Premier and up)

- Free Quicken Bill Pay included with Premier and up

- New custom invoices with your logo, color, payment links to Paypal and web links to Yelp (Home, Business & Rental Property only)

- Email rent reminders, receipts, and business invoices directly from Quicken (Home, Business & Rental Property only)

Quicken 2018 New Features for Mac

- Three versions for Mac: Starter, Deluxe, and Premier

- Support for 11,000+ online billers for automatic bill tracking

- 5GB free secure online backup with Dropbox

- Customizable investment portfolio views (Deluxe and up)

- Investment tracking by lot (Deluxe and up)

- Loan analysis with variable payment scenarios (Deluxe and up)

- Free Quicken Bill Pay included (Premier only)

Nate Phillips has been using Quicken and TurboTax for almost 20 years. He has spent part of that time as a Quicken beta tester, helping identify bugs and annoyances with Quicken updates before they are released. Nate holds a master’s degree in Computer Science and has numerous technology certifications.

Mint

Quicken 2018 Reviews By Consumers

Mint

Account setup

Transaction sorting

Visualizes spending

Budgets feature

Why we chose it

Account setup

If you’re totally new to money management, Mint is the way to go. The simplicity starts with account setup. Mint links all of your accounts with the same bank in one fell swoop, so it only takes a minute to get rolling. Then it pulls two months’ worth of transaction history and begins categorizing.

Transaction sorting

Intuit’s products (the other being Quicken) nail down transactions better than any other software we looked at. They even break down subcategories (think: “Fast Food” instead of “Restaurants”), making it easy to visualize and categorize your monthly spending.

Mint (left) labels every transaction clearly, while Personal Capital (right) uses general categories.

Visualizes spending

Mint uses a unique pie chart system to show you how your income and expenses break down, and it allows you to adjust these charts to show spending for specific categories, accounts, or time periods. This is a level of financial visibility we didn’t see anywhere else. It gives you deep insight into your own habits so you can check in and make adjustments if need be.

Mint automatically visualizes your spending habits, so you can see where your money’s going at a glance.

Budgets feature

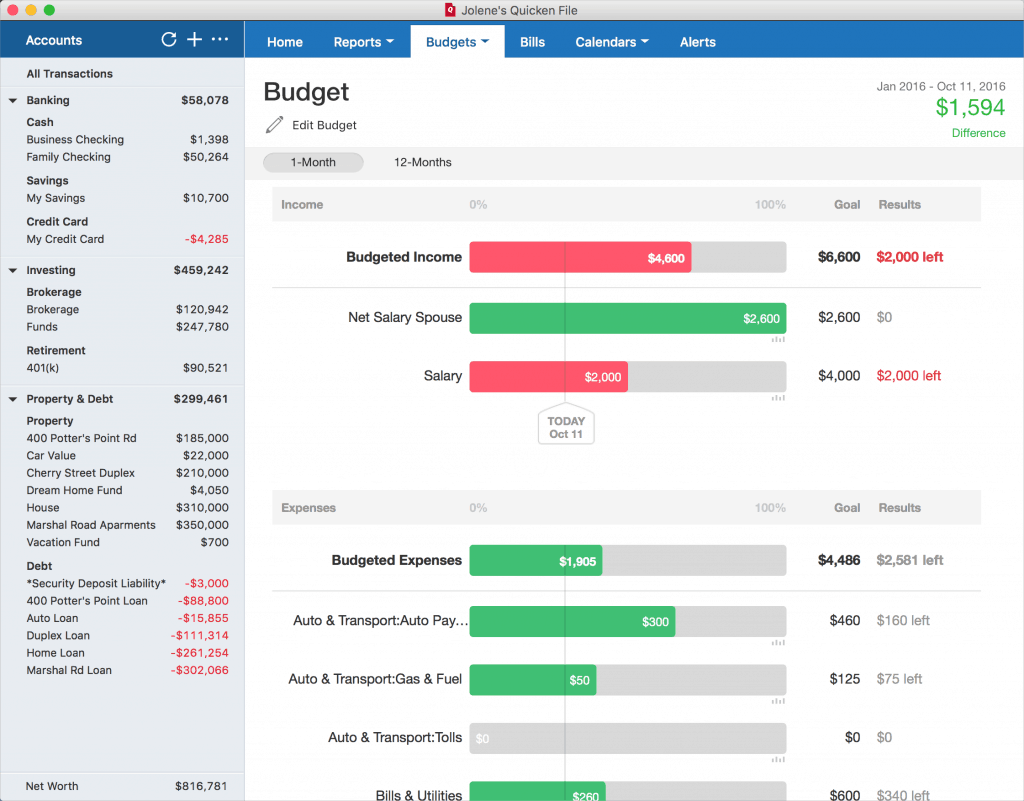

Mint allows you to create budgets for a number of categories. Start with the preset budgets, like 'Restaurants' and 'Transportation,' or create as many custom categories as you like. After doing so, the software will automatically fill them in. We did notice that Mint isn’t as smart about labeling budgets as it is with transactions (it slotted a bus pass into “Education,” for example), but after a little tinkering, it’s great for automatically tracking your spending.

With your budgets and savings goals shown in bar graphs like the one above, it’s easy to log in and make on-the-spot financial decisions. For instance, you can pull out your phone at the grocery store, look at your grocery budget, and decide whether to splurge on the $25 rosé or stick to the $10 bottle (without doing any frantic mental math).

Mint shows your budgets clearly, so you can check in and see how you’re doing at a glance.

Points to consider

Reviews Of Quicken 2018

Banner ads

Reviews Of Quicken 2018 For Mac

We love that Mint is a free personal finance app — but that does mean putting up with banner ads. They’re not overwhelming, but you will have to scroll through some full-screen credit card and loan offers. If you’re looking for a more streamlined experience, we recommend checking out Quicken.