See more reviews for Quicken 2018 Quicken makes managing your money easier than ever. Whether paying bills, upgrading from Windows, enjoying more reliable downloads, or getting expert product help, Quicken's new and improved features will help you save time and get better control of your money. Quicken Starter: At $34.99/yr, this version is the simplest version of Quicken with access to the budgeting tools only. Quicken Deluxe: At $49.99/yr, this version is an expansion of Starter with access to the budgeting and some basic investment tools.

- Pros

Robust set of personal finance, planning, and investment tools. New companion site. Flexible transaction tracking. Useful reports and graphs. Excellent support options.

- Cons

Expensive. Inconsistent user experience. Electronic bill pay not available in all plans.

- Bottom Line

Quicken Deluxe contains more personal finance management tools than any competitor, but it's relatively expensive and many features aren't available in the mobile apps.

Quicken, after 25 years of existence, has finally launched something that users have wanted in the personal finance app for a long time: a companion website that mirrors the features and information found in the desktop version. Now, you can work on much of your Quicken data in a web browser, from anywhere, since the data is stored in the cloud and syncs with your desktop file. The new web access capabilities also take away some of Quicken's intimidation factor and makes it more competitive with state-of-the-art personal finance websites. As a result, Quicken is the Editors' Choice for paid personal finance services.

- $0.00

- $0.00

- $0.00

- $9.99

- $19.00

- $5.00

- $0.00

The new virtual tools are available for all versions of Quicken 2018 and 2019, which is a major improvement. As Quicken has matured over the years, it's become so feature-heavy and slow on older PCs (though the 2019 version offers many performance improvements) that it's just too much for some users—and too expensive. But there's no denying that it's the most feature-rich personal finance application available today.

Versions and Pricing

There are four versions of Quicken 2019. All let you download transactions so that you can get a comprehensive view of your finances through a variety of lenses. You can simply track your income and expenses, create budgets, and run reports in the most junior version. If you want to view and manage your investments, track your property and debt, pay bills online, and do long-term planning, you'll find tools for those actions in the more advanced plans. Quicken's newest tools—especially the companion website—offer a state-of-the-art user experience, but make older features look dated by comparison.

Quicken launched a membership program with its 2018 version. Instead of paying for the application upfront, you now pay for a one- or two-year membership and receive upgrades as long as you maintain your subscription. Quicken Starter ($34.99 per year) is best for consumers who just want to connect to their online financial accounts and track income and expenses, monthly budgets, bills, reports, calendars, and alerts. The version tested here, Quicken Deluxe ($49.99), adds sophisticated investment tracking. Quicken Premier ($74.99 per year) offers Quicken BillPay and priority access to customer support. Quicken Home & Business ($99.99 per year) allows you to track business data as well as personal income and expenses.

The competition has grown steadily, though, as you can see from our reviews of rival personal finance web services, such as Credit Karma, NerdWallet, and Mint, the Editors' Choice for free personal finance services. With those services, you can get a lot of good personal finance functionality for little or no monthly cost and have anytime, anywhere access.

Some Setup Required

Quicken 2019 comes ready to use, but there are some setup chores you should do to make it work the way you want. Open the Edit menu in the Windows toolbar, select Preferences, and choose from options related to program functions like navigation, the register display, and downloaded transactions. Of course, you'll need to connect your online accounts if you want Quicken to import cleared transactions from your financial institutions. The software supports spending and saving, property and assets, investing and retirement, and debt accounts. You usually just supply the user name and password that you use to log in to these online accounts to set up the connection. Mint and other competitors work similarly.

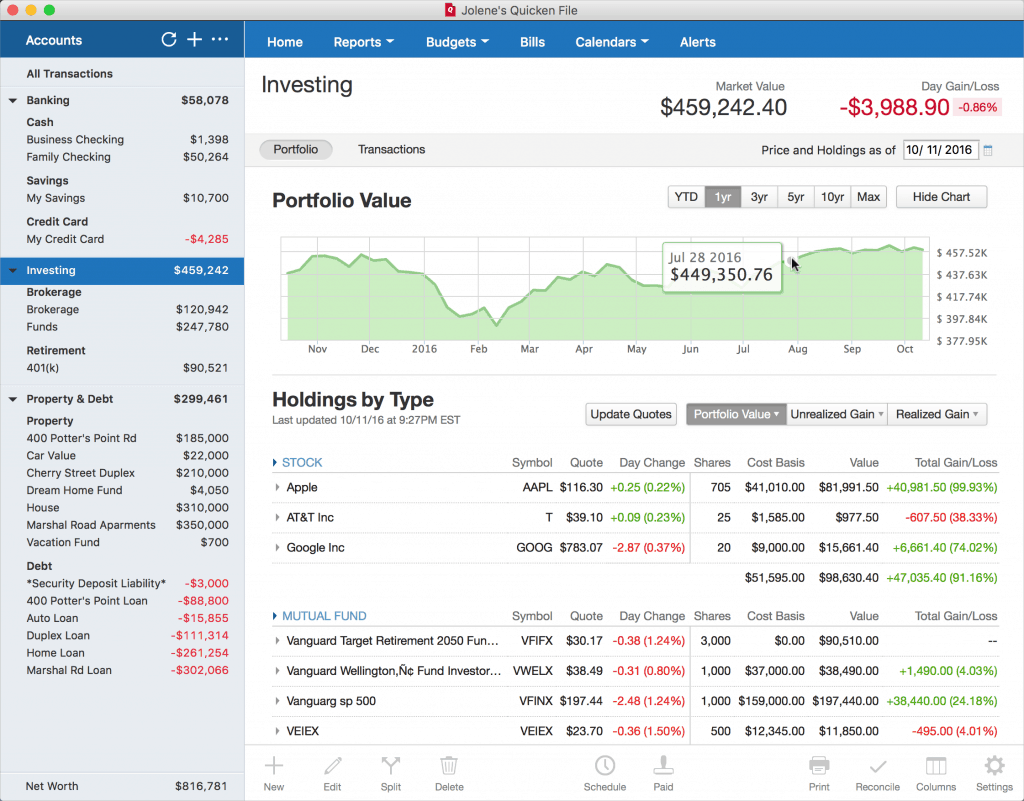

Quicken looks and works much like it did previously, though, as noted earlier, its performance has improved. The home page is designed to give you a thorough overview of your finances. The left vertical pane displays all of your accounts: Banking, Investing, Property & Debt, Planning, and Tax. Clicking on any of these takes you to a more detailed view. Your net worth appears at the bottom of the pane, as well as a link to your credit score. To get your credit score, you must sign up for Quicken's free service. Unfortunately, Quicken's free credit score is only updated quarterly, as opposed to Credit Karma's weekly updates.

The home page is highly customizable. You can choose from numerous types of tables, charts, and other graphical content to display there. You could, for example, choose a calendar that shows what happens every day, such as expected income and upcoming expenses or overdue transactions. There are lists of bill and income reminders, graphs illustrating total spending by category, asset allocation charts, and budget adherence reports. You can also save multiple views containing different groupings of content.

Comprehensive Coverage in Quicken

Quicken has for many years included some tools that many people will never use, such as long-term planning tools and the more sophisticated investment- and property/debt-tracking features. But they're there and stay out of your way when you don't need them. If you're not familiar with Quicken, you should click through the program tabs (such as Investing and Property & Debt) at some point, as you might find something you'd like to explore. But the sheer volume of tools available can be overwhelming. No one else comes close to providing such a wealth of guidance and tracking tools in either a software or web-based application.

Take the Planning interface, for example. Budgets is likely the most used tool in this section. Here, Quicken Deluxe lets you create multiple budgets based on categories you choose. You can view your progress in an easy-to-understand graphical format. Other features in this section help you reduce debt, make a lifetime plan, track and project income taxes, and establish savings goals. These interactive tools combine fill-in-the-blank fields, sophisticated calculators, and reports. They then feed your responses back to you as graphs and tables.

Quicken For Mac 2018 Release Date

If you have an investment portfolio, you can track prices during the market day; see detailed views of individual securities; monitor and change your asset allocation; and estimate capital gains. Property owners (vehicle, home, or other assets) can use a wizard to create accounts for assets and track their progress toward ownership.

If you have enough financial resources that you'd make use of all of Quicken's personal finance tools, you'll be spending a lot of time keeping the software current. Such compliance can result in meaningful feedback and guidance from Quicken, but it takes constant commitment. It's not something you can do half-heartedly. A financial professional can run similar numbers for you and can go a step further using more sophisticated tools, offering expert, personalized advice that Quicken can't. It depends on how diligent you want to be and your confidence level.

Spending and Income

From its earliest days, Quicken has focused on personal income and spending. If you only use the software to track your money (including investments) and don't access its longer-term planning and tracking tools, it's worth the few dollars per month that you pay in subscription fees for Quicken Deluxe as opposed to Starter.

Click the Spending tab, and you arrive at a big, colorful chart that illustrates your spending by category over the last 30 days. You can modify this date range to cover alternate periods and view the graphic by individual or all accounts. Below that is a register containing transactions that have been imported from your financial institutions or entered manually.

You can toggle this register to reflect either income or spending and access tools that let you really micromanage your transactions. The transaction options include splitting them; adding notes, flags, and attachments; changing categories; and assigning tax lines. Accurate categorization of your transactions is very important. It makes your reports more useful and your taxes correct should you use Quicken data to help prepare your income taxes.

The Bills and Income tab deals primarily with your incoming bills. You can enter each manually or connect to online billers where you have accounts to download the pertinent details, and view the list by biller name, due date, or as a graphical calendar. Once a bill has been added, you can edit it (once or for all future occurrences), mark it as paid, and enter it as a transaction in the appropriate register.

Income is also addressed in this section of Quicken, which is puzzling at first. I would have expected to see it grouped with spending. But the logic becomes clear after you see that not only can you track your income in multiple views, but you can also see a chart that projects your account balances based on upcoming bills and income. What you can't do, though, is actually pay bills electronically in Quicken Deluxe. You'd need one of the two more expensive subscriptions for that. You can, of course, print checks.

Excellent Support

Quicken has a learning curve. It takes some time to simply learn what it can do and how each area of the software integrates with the others. But you don't have to explore everything. Quicken has a huge range of capabilities that have been added on over the years; you can either use or ignore them.

If you do choose to tackle the more sophisticated features, there's plenty of support available. There are written guides and videos, an active online community, and FAQs. You can also chat with a support agent 24/7 or call one Monday to Friday from 5 a.m.-5 p.m. Pacific Time.

Accessing Quicken Remotely

As robust as Quicken is, you wouldn't expect to be able to access the lion's share of its features remotely. And you can't. iOS apps and Android apps are available. These apps include the tools and data you most likely need when you're away from your computer. You can view and add account registers and transactions and see charts illustrating your spending categories and overall spending and income. Your investment portfolio is even available, albeit not with all the complex desktop-based tools.

As mentioned earlier, the new browser-based companion to desktop Quicken (app.quicken.com) takes some of the intimidation factor out of the software for individuals who aren't power users (though those people would likely find it helpful, too). The site's dashboard is terrific, and may be all you need to look at for a quick overview. It displays tables and charts that show you, for example, how you're doing with spending and income and your most recent transactions.

Between this home page and its links, you can view your account balances and their corresponding registers; work with and add transactions; see how you're meeting your budget goals; and watch your investment portfolio prices in real time. Though it doesn't include every feature in Quicken's desktop version, the web version gives you the numbers you'd most want to see when you check in.

Quicken Excels

If you're considering a personal finance application for the first time, we'd suggest you start with Mint, our five-star Editors' Choice for free personal finance services, as it doesn't require a financial commitment.

That said, Mint is a web-based affair, and many people prefer a dedicated desktop app. That's where the 2019 edition of Quicken Deluxe shines. You'll pay an annual fee, but Quicken Deluxe includes excellent reports, transaction tracking, and good support. Toss in the new, optional web-based interface, and Quicken is a PCMag Editors' Choice.

While you're working on getting your personal finances in order, you should also make sure you know which personal tax preparation service you're going to use in the upcoming tax season. Our roundup can help you decide.

Quicken Subscription Review

Quicken Deluxe

Bottom Line: Quicken Deluxe contains more personal finance management tools than any competitor, but it's relatively expensive and many features aren't available in the mobile apps.

- $39.95

- $49.99

- $29.99

- $24.99

Quicken Inc. announced the next version of its self-titled flagship product, Quicken for Mac 2018 (and Quicken for Windows). The company has three different version of the accounting and billing software, Quicken Starter, Quicken Deluxe, and Quicken Premier. Following the lead of other companies, Quicken said the upgrade will be available by subscription, only.

At the end of this article, we have links to Amazon pricing that includes three free months.

Quicken for Mac 2018 ScreenshotNew Features

Chief among the new features is access to online bills from more than 11,000 billers. They’re integrated into what Quicken called, “a streamlined bill workflow.” There are also expanded investment capabilities with specific lot tracking; a “highly” customizable portfolio view; and, loan tracking features that include “what-if” loan analysis.

DropBox Storage Bonus, Yelp and PayPal Integration

Quicken Software For Mac

Subscribers get an additional 5GB of additional storage from DropBox included with their subscription. Premier memberships also include the ability to include Yelp links and PayPal payments in bills.

Quicken for Subscriptions

Subscriptions (or “memberships”) are sold in one or two-year increments. The company pitched this pricing as allowing customers to get a continual stream of updates, rather than buying major new versions. They may be counting on Mac users forgetting the long, long, long passages of time that passed between Quicken for Mac updates when Intuit still owned it.

That said, many will likely see this pricing as reasonable. Here’s how it breaks down:

Quicken Deluxe For Mac 2018 Reviews

- Quicken Starter (Mac & Windows):

- One-year membership: $34.99

- Two-year membership: $49.99 (available at retail)

- Quicken Deluxe (Mac & Windows):

- One-year membership: $49.99

- Two-year membership: $79.99 (available at retail)

- Quicken Premier (Mac & Windows):

- One-year membership: $74.99

- Two-year membership: $119.99 (available at retail)

Quicken for Mac 2018 is available now at Quicken.com, Staples, and Amazon. Amazon has 27-month subscriptions for the two-year prices listed above (Starter, Deluxe, Premier)