- Quicken 2019 For Mac

- Quicken 2019 For Mac Torrent

- Intuit Quicken 2019 For Mac

- Office 2019 For Mac Release Date

- Windows Office 2019 Release Date

- Quicken Deluxe 2019

- Quicken 2019 For Mac Release Date

The Mac version of the Quickbooks Pro is 6 times the cost of the PC version, $225/year for the PC vs. $1330/year for the mac version AND the mac version has compatibility issues. Quicken 2019, for both Mac and Windows products, was ushered in with only small bug-fix releases, not major changes like in the pre-subscription days. I can't imagine why Quickbooks would convert a Quicken 2019 data file but not a Quicken 2018 data file, since there was no change to the database structure.

Screenshot of Quicken 2005 Premier Home & Business | |

| Developer(s) | Quicken Inc. |

|---|---|

| Initial release | 1983; 36 years ago |

| Stable release | |

| Operating system | MS-DOS, Apple II, Windows, Classic Mac OS, macOS, iOS, Android |

| Type | Accounting software |

| License | Proprietary |

| Website | quicken.com |

Quicken is a personal finance management tool developed by Quicken Inc. (formerly part of Intuit, Inc.). On March 3, 2016, Intuit announced plans to sell Quicken to H.I.G. Capital; terms of the sale were not disclosed.[1]

Different (and incompatible) versions of Quicken run on Windows and Macintosh systems. Previous versions ran on DOS[2] and the Apple II.[3] There are several versions of Quicken for Windows, including Quicken Starter, Quicken Deluxe, Quicken Rental Property Manager, Quicken Premier, and Quicken Home & Business, as well as Quicken for Mac.[4] Since 2008, each version has tended to have the release year in the product name (e.g., Quicken Basic 2008); before then, versions were numbered (e.g., Quicken 8 for DOS).

Quicken's major marketplace is North America, and most of the software sold is specialized for the United States and Canadian marketplace and user base. But the core functions can often be used more widely, regardless of country; and versions have been tailored for a variety of marketplaces, including Australia, Germany, Hong Kong, India, New Zealand, the Philippines, and Singapore.[5] Development of the UK-specific version of Quicken was stopped in January 2005, with sales and support ending shortly afterwards. There were also versions for Argentina, Brazil, Chile, Colombia, Costa Rica, Denmark, Ecuador, France, Mexico, the Netherlands, Spain, Sweden, Switzerland, Uruguay, and Venezuela.[5]

- 4Editions

- 4.1Current

Product description[edit]

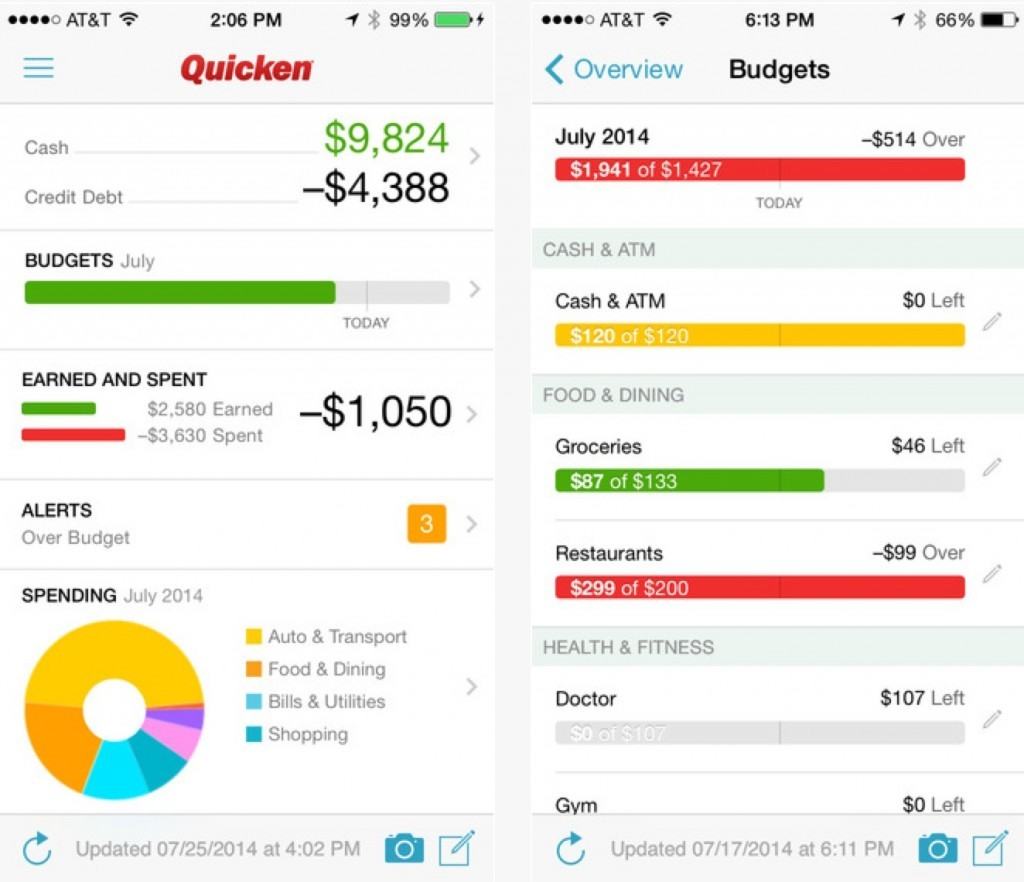

The Quicken name typically refers to the core product offering of personal financial management software. The software includes financial planning activities that, historically, people may have done on paper – recording banking transactions, planning a budget and measuring progress against it, tracking investments and their prices and performance. Quicken has offered various editions, with varying prices – such as Basic which includes only those typical activities for someone with simple banking accounts, to Small Business for someone who also runs a business out of their home.

Quicken includes online services that allow users to retrieve transactions from various providers – such as their bank or credit card company. In most cases, online services and technical support are now supported for up to three years after the product's labeled version. e.g. Quicken 2018 will be supported until 2021.[6]

Related products[edit]

Quicken 2019 For Mac

The Quicken brand has been extended to other personal and household areas, including healthcare. Quicken Health Expense Tracker is a free online tool for healthcare consumers enrolled in participating health plans. Users can 'manage and direct their health care finances, view and organize medical expenses, payments and service histories, and download and organize personal health claims data.'[7] The Quicken Medical Expense Manager is a desktop software tool for managing healthcare paperwork, tracking claims and payments, and consolidating related information.

Quicken Kids & Money was a Web-based program that aimed to help parents teach five- to eight-year-old children how to earn, spend, save, and share money. It is defunct.[8]

Other products are aimed at home business and seem to fit in a space for a less formal business than would be using QuickBooks. Quicken Rental Property Manager is a desktop software tool for managing rental properties; tracking tenants, expenses, and payments; and producing tax reports.

Software as a service[edit]

Quicken Online was a free, hosted solution (see software as a service) by Intuit. Intuit hosted all of the user's data, and provided patches and regularly upgraded the software automatically. Initially this was launched as a monthly paid subscription, and was a free service for over a year.

Intuit completed the acquisition of competitor Mint.com on November 2, 2009.[9] Quicken Online was discontinued on August 29, 2010, and users were encouraged to transition to Mint.com.

Beginning with Quicken 2018, Quicken is now a subscription service. Annual memberships can be purchased directly from Quicken.com and two-year subscriptions can be purchased through several retailers.[10]

Editions[edit]

The following are current (selling and supported) and retired (discontinued in both sales and support) versions of Quicken.

Current[edit]

Selling[edit]

- Quicken (Starter, Deluxe, Premier) 2019 for Windows[11]

- Quicken (Starter, Deluxe, Premier) 2019 for Mac[11]

- Quicken Home & Business 2019 for Windows[11]

Supported[edit]

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2017 - expires April 30, 2020

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2016 - expires April 30, 2019

- Quicken 2017 for Mac

- Quicken 2016 for Mac

- Quicken 2015 for Mac

Retired[edit]

(Dates retired are shown.) [12]

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2015 - April 30, 2018

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2014 - April 30, 2017

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2013 - April 30, 2016

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2012 - April 30, 2015

- Starter, Deluxe, Premier, Home & Business Edition 2011 - April 30, 2014

- Starter, Deluxe, Premier, Home & Business, Rental Property Manager 2010 - April 30, 2013

- Starter, Deluxe, Premier, Home & Business 2009 - April 30, 2012

- Basic, Deluxe, Premier, Home & Business 2008 - April 27, 2011

- Basic, Deluxe, Premier, Home & Business 2007 - April 30, 2010

- 2006 (Win) – April 30, 2009

- 2005 (Win) – April 30, 2008

- 2004 – April 30, 2007

- 2003 – April 25, 2006

- 2002 – April 19, 2005

- 2001 – April 19, 2005

- 2000 – May 18, 2004

- 98 and 99 – April 20, 2004

- Version 6 for Windows. 'Designed for Windows 95. Release 6.0. (c) 1996'

- Version 3 for Windows 3.1

- Quicken Essentials for Mac - April 30, 2015

- Quicken for Mac 2007 - retired October 2016[12]

- Quicken Mac 2007 OS X Lion compatible - retired October 2016[12]

- Quicken for Mac 2006

- Quicken for Mac 2005 - retired April 30, 2015

Criticism[edit]

Intuit stopped supporting its Quicken software in the United Kingdom in 2005, leaving many thousands of users with only partly functional software.[13]

In 2008 and 2009, Quicken users reported an unusually large number of software bugs for a commercial product.[14][15][16] A review of Quicken 2010 suggests that quality and user interface in that product year is dramatically improved.[17]

Existing Quicken Online users' data is not transferable/importable into Mint.com. This is in direct contrast to VP Aaron Patzer's promise, made on April 27, 2010: '[Until the merger with Mint.com is complete], you can continue to use Quicken Online just like you have. Once we have completed integrating all features to Mint, you will be able to easily transfer your information and data to ensure the smoothest transition possible.'[18]

History of Quicken and the absence of a common cross-platform file format[edit]

Quicken 2019 For Mac Torrent

Quicken uses a database file structure. Since Quicken started on MS-DOS and the Apple II back in 1983 (before the Macintosh appeared in 1984), a database structure of choice[which?] did not exist for the Macintosh, nor has there really been a good common database structure developed that was cross-platform compatible created in the early days. So, when Mac development started, it had to take an independent path, and the DOS version transitioned to Windows.

Then when Mac OS X came out in 1999 (server) and 2001 (desktop), a new platform emerged. Apple developed backward compatibility for OS 9 (and predecessors), so Quicken for Mac development continued in an older platform database structure (PowerPC-based). Apple continued to support PowerPC-based apps (via Rosetta) on their Intel-based Macs in August 2009 (via Mac OS X 10.6). Rosetta was a temporary measure to support the eventual transition to exclusively Intel-based software (achieved in March 2011 with the release of OS X 10.7 (Lion)).

In 2009, faced with the eventual retirement of the PowerPC, it was deemed that the structure for Quicken for Mac (2007) was not suited for the direction of the Mac (intel) and OS X.[citation needed] Though they got Quicken for Mac 2007 to run on Intel in 2012,[19] Intuit decided to start from scratch and Quicken Essentials for Mac (QEM) was created in 2010.[20] Quicken 2015 for Mac, released in August 2014, and later versions for Mac are built on the Quicken Essentials for Mac foundation.

See also[edit]

References[edit]

- ^John Rebeiro (March 3, 2016). 'Intuit selling Quicken to private equity firm HIG Capital'. pcworld.com. IDG Consumer & SMB. Retrieved March 4, 2016.

- ^'Quicken for DOS'. Intuit, Inc. Archived from the original on 2011-07-17.

- ^Field, Cynthia E. 'Quicken Offers Check Writing, Budget Analysis for Apple IIs'. InfoWorld. March 17, 1986: 35–36 – via Google Books.

- ^'All Quicken Products'. Intuit.

- ^ ab'International Versions of Quicken'. Intuit. 2011-06-20. Archived from the original on 2013-01-26.

- ^'Retirement of online services for older versions of Quicken'. Intuit/Quicken. Retrieved 2007-06-13.

- ^An April 2007 article in the San Jose Business Journal.

- ^'Quicken Kids & Money Help'. Intuit Inc. Archived from the original on June 21, 2008.

- ^'Intuit Press Release - Intuit Completes Acquisition of Mint.com'. about.intuit.com. November 2, 2009.

- ^'Quicken 2018 Subscription Membership Pricing Explained'. Top Financial Tools. 2017-10-27. Retrieved 2017-11-09.

- ^ abc'Quicken 2018 - Which Version Do You Need? | Compare Quicken Products'. Top Financial Tools. Retrieved 2017-11-09.

- ^ abc'Currently Supported Quicken Products (Discontinuation Policy)'. Quicken. 2016-02-09. Retrieved 2017-11-09.

- ^Oates, John (2005-01-17). 'Intuit UK kills Quicken and TaxCalc'. The Register. Retrieved 2009-04-06.

- ^nathanau (2008-01-27). 'Quicken Community - Quicken 2008 Bug List'. Quicken Community. Archived from the original on 2009-02-09. Retrieved 2017-01-17.

- ^thecreator (2008-08-28). 'Quicken Community - Quicken 2009 Bug List'. Quicken Community. Archived from the original on 2009-04-08. Retrieved 2017-01-17.

- ^Elmblad, Shelley (2009-01-14). 'The Best and Worst Features in Quicken'. About.com. Archived from the original on 2009-02-06. Retrieved 2017-01-17.

- ^Arar, Yardena (2009-10-29). 'Intuit Quicken Premier 2010'. Quicken Premier. Retrieved 2010-01-16.

- ^'Quicken Support - Quicken Community'. Intuit. Retrieved 2016-07-07.

- ^'Intuit releases Lion-compatible Quicken 2007'. CNET. 2012-03-08. Retrieved 2016-07-07.

- ^Snell, Jason (2010-02-24). 'After delays and criticism, Intuit releases Quicken Essentials for Mac'. Macworld. Retrieved 2016-07-07.

External links[edit]

Intuit Quicken 2019 For Mac

Mac users last saw a new version of Quicken, Intuit’s personal finance app, in 2006. The company hopes to change that this summer when it rolls out the completely rebuilt and renamed Quicken Financial Life for Mac.

With Quicken Financial Life, Intuit is scrapping the code it used for Quicken and starting from scratch. That approach has allowed the company to not only give the app a new look but also add features that take advantage of Mac OS X 10.5. It’s also taken longer than Intuit originally anticipated—first announced more than a year ago, Quicken Financial Life missed its original fall 2008 release date.

On the bright side, early indications suggest that Quicken Financial Life may be worth the wait. I had the chance to play with a beta of the retooled personal finance app. While Quicken Financial Life is still very much a beta—at this point, it’s fairly limited in terms of completed features—I like what I see so far.

The Register is dead, long live the Register

Office 2019 For Mac Release Date

For better or worse, Intuit has used a checkbook-like register for recording checks, deposits, and other banking transactions, with buttons across the top of the screen for accessing each of the program’s features. While it’s impossible to completely dispense with the ledger-like look of a checkbook register, Intuit has managed to change the way you approach that ledger and the way that you interact with your banking data.

Quicken Financial Life has a decidedly less cluttered feel than the current version of Quicken. A sidebar on the left of the screen, similar to the sidebar you use in Apple Mail, contains links to all your accounts and available reports. Selecting anything in the sidebar—say, your checking account—reveals a list of transactions for that account. According to Intuit, it’s going to be much easier to download this data from your bank and import it into Quicken Financial Life.

Something new to Quicken Financial Life is the introduction of Tags for categorizing your transactions. Most financial applications let you assign categories to different transactions or “split” your transactions into discrete categories that make it easier to figure out where you spend your money. But typically, these categories are fairly concrete and, unless you split out an exact dollar amount, it wasn’t possible to assign more than one category to a transaction.

With the introduction of tags, it’s now possible to categorize your expenditures in less generic terms without losing the value of those generic categories. For example, all your iTunes Music Store purchases might typically fall under the generic heading of “entertainment,” but in Quicken Financial Life you can also add tags for applications, movies, music, and audio books, gaining a more specific picture of where your money goes without losing the big picture view of how much you’ve spent on entertainment.

See me, feel me, touch me

Quicken Financial Life is designed to help you take a more holistic approach to your personal finances, allowing you to take a broad view of your entire financial picture while giving you insight into where you currently stand and helping you make plans for the future. This is kind of a “touchy-feely” approach to finances, but one that I think has the potential to work well for many people. While it’s too early in the beta process to really see how likely Quicken Financial Life is to live up to this promise, there are two features—one qualitative and the other quantitative—that I like.

Windows Office 2019 Release Date

First is the program’s Tag Cloud, which, by using your transaction tags, and without using a single graph, chart or number, lets you gain a visual grip on where your money is going. It’s an intriguing feature that works quite well and which could expand into something really useful.

The second, called the Scorecard, is a little more typical of your average financial application, but it differs in that it lets you see every detail of your financial life in a single view. Scorecard provides lists of upcoming and overdue bills, and details on all your assets and liabilities. There are also graphs of your spending—vs.—income trends, your credit card balance trends, and overall spending trends. Most applications would require you to open or print a half-dozen reports in order to gather the same information. The fact that Quicken Financial Life lets you see all of this information in a single location may make it easier to get a grip on your present financial situation and your financial future.

First impressions

Quicken Financial Life remains a work in progress at this early stage, with many features not yet implemented. But the features that are working at this moment make this program worth watching as it gets closer to its slated summer ship date.

Quicken Deluxe 2019

We’ll have more on Quicken Financial Life once the finished version appears later this year.

Quicken 2019 For Mac Release Date

[Jeffery Battersby is a (very) smalltime actor, IT manager, and regular contributor to Macworld.]