Quicken is one of the oldest personal finance software packages.

Quicken is an on-premise personal finance management tool that allows users to manage their financial accounts and investments in one place. The platform is available only for Windows and Mac users.

Quicken's origins go all the way back into the 1980s, when Scott Cook and Tom Proulx founded Intuit in Palo Alto, CA. As Intuit's history tells it, they realized that personal computers would change the way people did personal accounting. Quicken was programmed in Microsoft BASIC for the IBM PC and UCSD Pascal for the Apple II.

There were several firsts in the origins of Quicken. For example, Intuit offered a $15 rebate on the purchase, the first time software offered a rebate. In 1991, Microsoft created Microsoft Money to compete with them (Microsoft Money was discontinued in 2009).

In 2016, Intuit sold Quicken to H.I.G. Capital, a private equity firm in Miami.

Nowadays, Quicken has a ton of competitors. Many of them live on the cloud, are free, and don't require you to pay or install software. One of their biggest competitors is Personal Capital, which offers free financial dashboarding tools as well as wealth management (optional). If budgeting is what you're after, Mint (now owned by Intuit, which formerly owned Quicken) is a free powerful budgeting tool that has many fans too.

So how does Quicken 2018 compare with predecessors and should you continue using it?

The Many Versions of Quicken

Quicken has several versions:

- Quicken Starter: At $34.99/yr, this version is the simplest version of Quicken with access to the budgeting tools only.

- Quicken Deluxe: At $49.99/yr, this version is an expansion of Starter with access to the budgeting and some basic investment tools.

- Quicken Premier: At $74.99/yr, this mid-tier version offers all that Deluxe covers plus Quicken Bill Pay, Priority access to customer support (a $49.99/yr value if purchased separately), plus advanced investment portfolio analysis.

- Quicken Home & Business: At $99.99/yr, this type gives you all that Premier offers plus business management tools like invoicing and rental tools.

It's organized such that Quicken Deluxe is for most users who are focused solely on budgeting with an eye towards investments. The investment tools are very basic, meant to keep an eye on things but not necessarily plan for the future.

In Quicken Premier is where all the good investment planning and preparing tools exist. You get portfolio analysis, comparisons of your returns vs. market, track cost basis and create Schedule D tax report, plus budgeting focused tools like bill pay.

Quicken Home & Business is exactly what it sounds like – if you have a business, including a rental property, then this tier covers you. I'd argue that you may look at other options for business management tools but this is a good option if you want to keep everything under one Quicken roof.

Personally, I like keeping home finances and business finances separate from a management perspective. I think of business needs differently from personal needs so being in a different package helps cement that difference. There is no legal reason to keep the software separate though, you just need to keep the actual finances separate.

The Many Features of Quicken 2018

If you have no experience with Quicken, many of the features of Quicken 2018 will be novel to you but have been around for quite some time.

Some popular features from previous versions:

- Transaction and expense management is the hallmark of Quicken, with the ability to track transactions on the go.

- Bills management lets you see, track, as well as pay your bills within Quicken.

- Phone support is included with all tiers, priority access is available for Premier and Home & Business.

- A free credit score is included under Reports > Credit Score, you get a free updated score every three months. (there are now many free tools that offer a free credit score)

- A powerful mobile app is now included, with investment tracking, offline usage, and charting tools.

What's new for 2018 (just a small sampling):

- Online billpay is now available with over 11k+ merchants.

- Online cloud backup with 5GB of storage on Dropbox.

- Send invoices via Home & Business and customize them with your logo and other design features. Includes email reminders.

The Many Problems of Quicken

Quicken's history of issues is well documented. Whether it's downloading transactions, connecting with your bank, accessing data, etc – the laundry list is quite long.

Of course, people don't sing praises as often as they complain about problems. There's always a bias towards the negative when you look online.

That being said, it sounds like some of these problems will be alleviated by going to a model where you have a subscription service and have access to frequent upgrades and updates. It remains to be seen whether the sync issues will subside but it's something to keep an eye on.

Quicken Premium Support, included in the higher tiers of software, offers to give you hands-on help with practically everything – installation and updates, product registration, online banking, Quicken file migration, and the financial planning tools to include the reports, budgets, etc. If you can get premium support, chances are you'll find a solution and won't be frustrated Googling your way into oblivion.

(be wary of Quicken support scams, they're rampant if you google search for it — only go through the Quicken website directly!)

Quicken System Requirements

The needs of the Quicken software are modest.

Here are Quicken's technical requirements for Windows:

- Operating System: Minimum Windows 7, 8/8.1, or 10

- Memory: Minimum 1 GB Memory

- Hard Disk Space: Minimum 450 MB free disk space; 1.5 GB if .NET is not installed

- Monitor: 1024×768 or higher screen resolution, 1280×1024 minimum for Large Fonts settings

- Microsoft .NET 4.6 or newer (Quicken installer will install .NET if it's not already installed on the system)

- Internet Connection: Broadband internet connection recommended; internet connection required for registration

Here are Quicken's technical requirements for Mac:

- Operating System: Mac OS X 10.11 (El Capitan), 10.12 (Sierra), or newer

- Memory: Minimum 256 MB Memory

- Hard Disk Space: 100 MB, More memory and hard drive space may be required for large data files

- Monitor: 1280×800, 1366×768 or greater

- Internet Connection: Broadband internet connection recommended; internet connection required for registration

Quicken Membership Subscription Pricing

Starting with Quicken 2018, instead of buying the software outright, you pay a subscription fee. The subscription is 12 or 24 months long.

If you purchase the package from, say Amazon, you may get bonus features. For example, Quicken Deluxe 2018 (24-mo) is available on Amazon with a 27-month subscription (3 months free) as well as 15GB of online backup with Dropbox, plus free priority access to customer service. With the 12-mo version, you get 14 months (2 months extra).

For many, this change can be annoying. Rather than buying the software once, you now have to subscribe and pay every month. There were many users who bought Quicken every few years, because honestly how often does it really change? Is managing a budget in 2000 different than 2005? Probably not.

One of the upsides with the regular subscription payments is that you get new feature upgrades and updates as they are released. You also get access to online secure backup via Dropbox.

Options Better Than Quicken

With the change in pricing, you might be tempted to switch.

There are a lot of startups who have built powerful budgeting and investment planning tools to support premium services. I'll explain some of the best options I believe are better than Quicken (plus how they're able to offer this service for free).

For planners and investors, Personal Capital is the best option as a Quicken killer. It offers a suite of powerful tools to help you plan your investment strategy, analyze your existing investments for holes and imbalances, while offering expense tracking (budgeting) tools that are pretty good. Their strength is definitely in the investment side so if you're looking for a budgeting tool first and investment seconds, the next option is better. Personal Capital is able to offer their tools for free because they charge for wealth management.

For personal accountants, Mint is the best option for tracking and categorizing your expenses. They have an investment tracking portion of the tool but the planning and projecting aspects are not as strong as Personal Capital. Mint's budgeting suite, though, is peerless because they've had such a long time to develop it. Mint was acquired by Intuit in 2009 and they shut down Quicken Online shortly thereafter. Mint is able to offer their tools for free because they are heavily ad-supported.

Lastly, for those looking to establish a budgeting process and get a handle on their finances (ie. do more than track it), You Need a Budget is your tool. They rely on a methodology for planning out your budget that has worked for thousands of members. They offer a free trial because You Need a Budget (YNAB) is not free, they do not have ads and they have a strong community and team supporting it.

Conclusion

Quicken For Mac Support

It's hard to know where Quicken will go. With new management, plenty of changes (including a subscription fee), it's hard to say what changes will be next as private equity firms do need to make investments pay off. If this level of uncertainty is difficult, consider one of the many Quicken alternatives out there (we profiled just a handful).

What do you think of Quicken?

Strengths

- Budgeting & investment tools

- 5GB Dropbox cloud backup

- Financial institution integration

- Premium customer service

- Integrated Bill Pay service

Weaknesses

- Monthly/Annual fee

- Owned by Private Equity Firm

- Potential synchronization problems (TBD)

Other Posts You May Enjoy

Best Personal Finance Software 2019 - Programs for Mac, Windows PCs

We spent over 60 hours testing 20 personal finance apps and programs to find the best budgeting and money management tools. Our choice for the best personal finance software is Quicken Premier. It combines the best budgeting tools with easy-to-use tax reporting. It can track your investments by letting you compare your portfolios with the market, as well as allowing you to track fund fees and set retirement goals. Quicken Premier is the most complete program we reviewed and a good choice for anyone looking to get a better handle on their finances.

Best OverallQuicken Premier

Quicken Premier connects quickly to your bank accounts and easily tracks your spending and your investments. It offers useful budgeting tools like online bill pay and budgeting alerts.

Best ValueQuicken Starter

When looking at the number of features available versus the cost, we found the Quicken Starter hits the sweet spot. It has the same budgeting tools as Quicken Premier but doesn’t track investments.

Best Mobile AppBuxfer

Buxfer is the best mobile app we reviewed. It’s incredibly easy to keep track of your spending and set up alerts for when you deviate from your budget. It is one of the easiest programs to use that we reviewed.

| Product | Price | Overall Rating | Connectivity | Budgeting | Reporting | Personal Investing | Noteworthy Feature | Best For | Options & Functionality | Bank & Credit Union Accounts | Credit Card Accounts | Investment & Retirement Accounts | Works on PC & Mac | Browser-Based | Mobile Apps | Budgeting Simplicity | Online Bill Pay | Budget Alerts | Track Remaining Budget | Copy Budget to Next Month | Goal Tracking | Net Worth Overview | Spending Reports | Cash Flow Reports | Personal Investing Reports | Tax Reports | Export to Tax Program | Portfolio Overview | Track Performance | Display Asset Allocation | Compare Portfolio to Market | Track Fund Fees | Retirement Goals | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quicken Premier | View Deal | 4.5/5 | 8.3 | 10 | 10 | 10 | Portfolio X-Ray | Investment Management | 100% | 100% | ✓ | ✓ | ✓ | - | - | ✓ | 100% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | PC Only | ✓ | ✓ | ✓ | ✓ | PC Only | ✓ | ✓ | ✓ |

| Moneydance | View Deal | 4/5 | 8 | 8.3 | 8 | 6 | P2P Lending Accounts | Reporting | 80% | 85% | ✓ | ✓ | ✓ | ✓ | - | ✓ | 100% | ✓ | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | ✓ | - |

| Buxfer | View Deal | 4/5 | 10 | 7.5 | 5 | 4 | Links to PayPal | Forecasting Budget | 100% | 70% | ✓ | ✓ | ✓ | ✓ | ✓ | Android, iOS & Windows | 100% | - | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | ✓ | - | - | - |

| Quicken Starter | View Deal | 4/5 | 7 | 9.5 | 7.8 | 1.3 | Snap & Store Receipts | Simple Budgeting | 100% | 100% | ✓ | ✓ | - | PC | - | ✓ | 100% | ✓ | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | ✓ | - | - | - | - | - | - | - |

| Banktivity | View Deal | 3.5/5 | 7 | 7 | 9.3 | 4 | Apple Watch App | Reporting | 90% | 80% | $ | $ | $ | Mac | - | iOS | 100% | ✓ | - | ✓ | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | - | - |

| CountAbout | View Deal | 3.5/5 | 9.8 | 5.8 | 5.5 | 3 | Customizable Categories & Tags | Simple Budgeting | 100% | 80% | Premium | Premium | Premium | ✓ | ✓ | ✓ | 80% | - | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | - | - | - | - |

| Mvelopes | View Deal | 3.5/5 | 9.8 | 6 | 5.5 | 1 | Financial Coaching | Envelope Budgeting | 100% | 80% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 75% | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | - | - | ✓ | - | - | - | - | - |

| Moneyspire | View Deal | 3.5/5 | 7 | 7.5 | 5.3 | 6 | Print Checks | Paying Bills | 75% | 75% | Plus | Plus | Plus | ✓ | - | iOS | 80% | Plus | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | ✓ | - | ✓ | - |

| YNAB | View Deal | 3.5/5 | 8 | 7 | 4.8 | 1.3 | Works with Amazon Alexa and Apple Watch | Budgeting | 75% | 65% | ✓ | ✓ | - | ✓ | ✓ | Android, iOS & Amazon Echo | 100% | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | - | - | - | - | - | - | - | - |

| BankTree | View Deal | 3.5/5 | 7.5 | 5.3 | 6.3 | 9 | Supports Multiple Currencies | Investment Management | 75% | 80% | $ | $ | $ | PC | - | ✓ | 70% | - | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | ✓ | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | - |

| iFinance | View Deal | 3/5 | 6.3 | 7 | 5.5 | 3 | Apple Watch App | Tracking Multiple Budgets | 65% | 80% | ✓ | HBCI support required | ✓ | Mac | - | iOS | 80% | German banks only | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | - | - | - | - |

| MoneyLine | View Deal | 3/5 | 6.3 | 4.8 | 6.3 | 2 | Transaction Management | Simple Budgeting | 75% | 80% | ✓ | ✓ | ✓ | ✓ | - | - | 90% | - | - | ✓ | - | - | ✓ | ✓ | ✓ | ✓ | - | - | ✓ | - | ✓ | - | - | - |

Best Overall

Quicken Premier

Our pick for the best personal finance software is Quicken Premier. Quicken is one of the most well-known names in personal finance, and it is constantly updating its software with new features.

The version of Quicken Premier we tested was incredibly easy to connect to any bank to track finances.

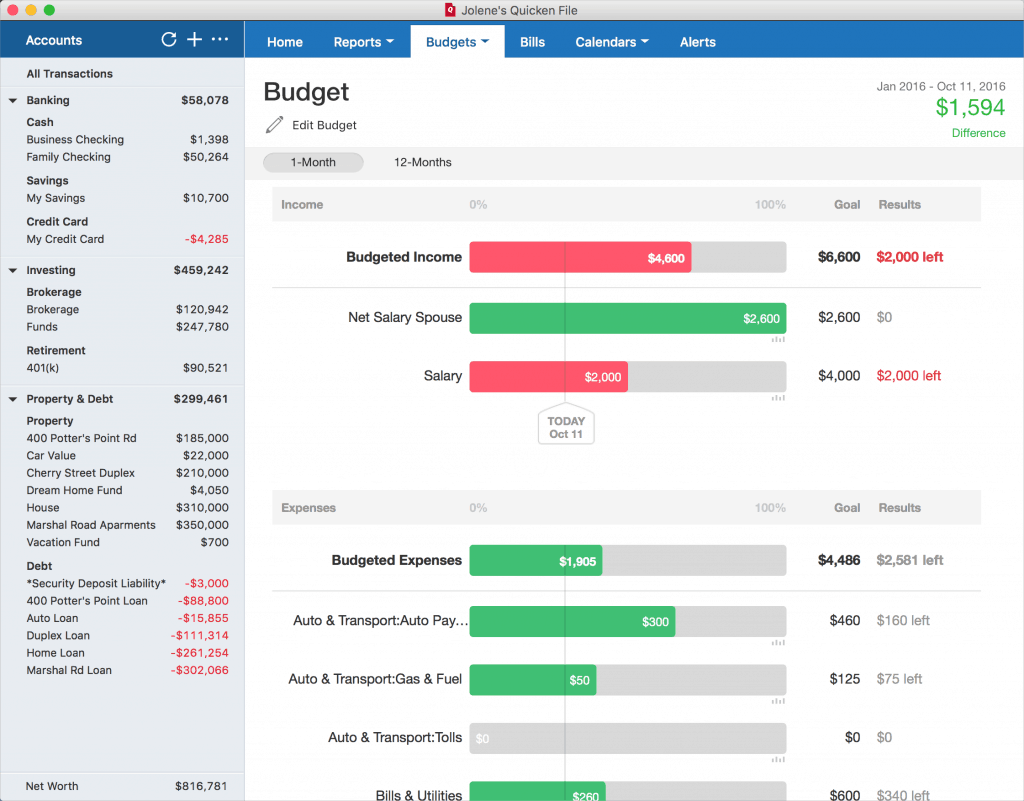

When you connect the program to your account, it will import your transactions and categorize them automatically. If something is incorrect, you can edit it. The categories are used to help you organize your budget. Quicken color-codes your budget, green for within budget and red for over budget. The program sends alerts when you approach or exceed your budget. Quicken gives you multiple options for setting up your budget. You can keep the same limit each month, or direct any unused amount to roll over into the next month.

Where Quicken Premier stands out is in its tools for managing investments. If you own stocks or other securities, this is the best choice for you. Its tools analyze your portfolio and compare its performance with the market. You can also create retirement goals and use the calculator to evaluate your finances and determine what you need to save toward your retirement goals.

Best Value

Quicken Starter

Quicken Starter is a scaled-down version of Quicken’s personal finance software. With a cost of $39.99, this is among the lowest-cost programs we reviewed.

This is our best value option because it gives you the same useful budgeting tools as Quicken Premier.

Quicken Starter connects directly to your accounts and imports your balances and transactions, automatically categorizing them. You can manually adjust the categories if default tags don’t match your budget.

Budgets are easy to create and can be divided into categories to track how much you spend on groceries, rent and other items. You can set up email or text alerts for when you approach or exceed your budget limit in a certain category. The Quicken mobile app also lets you check on your budget from your phone. You can also use the app to take pictures of receipts and add those to your records.

Quicken Starter has no tools for monitoring or tracking your investments. You can’t import information about your investments or use any of the tools for tracking fees or creating retirement savings goals. If you just want a personal finance program to track your spending and manage a budget, not having those investment tracking features shouldn’t be a deal breaker.

Best Mobile App

Buxfer

Buxfer PilotQuicken For Mac Reviews 2018 Honda

Having a mobile, web-based personal finance program makes it easy to track your spending and expenses from anywhere.

Once you create an account with Buxfer and download the app, you can connect it your bank and credit card accounts. Once connected, your balances and transactions are added to Buxfer and automatically categorized. You can also edit the information if the automatic categorization isn’t accurate.

Creating a budget with Buxfer is easy. You set an overall spending limit for each week, month and year you intend to budget. You can use the categories to further refine your budgeting. The budgets are color-coded. One advantage of being primarily app-based is that you can always have your budget available and reference it when you’re out shopping. Buxfer also has shared-expense tracking, which lets you send money to others, especially useful if you split rent or utilities with roommates.

Buxfer offers simple reports that help you visualize your spending. You can use the pie charts to determine what percent of your income you spend on various categories. Line graphs give you a quick view of your income versus your expenses. One drawback of Buxfer is that you can’t set up savings or retirement goals.

Best for Investors

Moneydance

If you have investments and brokerage accounts, Moneydance is one of the best options for you.

This program has tools to help you track your investments and monitor the progress of your portfolio. It syncs to your brokerage account and shows your balances and trades. In addition, it has reports that let you track your transactions and the performance of your investments. Moneydance is an easy-to-use program that lets you categorize your spending so you can see how much you spend and what you spend it on. You can also sync to your bank and P2P lending accounts to directly import your transactions.

Best for Envelope Budgeting

Mvelopes

Mvelopes Basic

Mvelopes is one of the best programs if you practice envelope budgeting.

With this method, you split your budget into envelopes marked with categories such as groceries, bills or entertainment. You then purchase items with money from the envelope category they fall under. Mvelopes lets you track your expenditures by assigning them to digital envelopes. When you exceed a spending limit, the envelope balance changes to red, and the program prompts you to address the situation by adding funds or letting it stay negative. This is a good way to visualize your spending and track where your money goes. One drawback is it doesn’t send you an alert when you go past a limit.

Why Trust Us?

We’ve reviewed personal finance software for 12 years. For this most recent update, we spent 60 hours using 20 programs before settling on the best 10. You may notice that some newer apps don’t appear in our reviews. We chose not to include free services like Mint or Personal Capital, though we may reconsider in future updates.

We did look at both of these programs. Mint is one of the most popular personal finance apps. It also offers a free credit score and has a wide range of alert options. Personal Capital doesn’t have budgeting tools, but it lets you track all your accounts and is very well-suited to people with investments they want to track.

How We Tested

To test these programs, we purchased or downloaded complete trials and used them to create budgets, connect to a bank account and monitor how well each program performs. We found that setting up your budgeting software can take some time, so be sure to give yourself an hour or possibly more. The best programs connect automatically to your bank, credit card or investment accounts directly. A few require you to import through Dropbox or another intermediary. Our Options & Functionality Score reflects this; anything with an 80 percent or above is easy to connect.

Once our transactions were imported, we let the program categorize them for us and began creating budgets. We noted the tools each program has to simplify the budgeting process, and whether you can copy the budget from month to month and set up recurring payments.

To make sure we tested these programs for all manner of financial scenarios, we also looked at the tools for monitoring investments. Many of the programs at least give you an overview of your portfolios and track their performance. The more extensive personal finance programs allow you to compare your portfolio to the rest of the market.

How Much Does Personal Finance Software Cost?

Personal finance software can cost as little as nothing or as much as $130 – much depends on what you want your software to do and if you prefer using an app, an online portal or a program downloaded to your computer. There are free apps like Mint and more robust apps like You Need A Budget, which costs $6.99 a month. If you have investments or need more complicated budgeting and accounting tools, a program you download may be your best choice. These usually cost around $50 to $130.

How to Choose a Personal Finance Software

Before settling on a personal finance program, take stock of what you need it for and how you’ll use it. Everyone’s financial situation is different, and some of these programs may not suit all your needs.

Basic Budgeting

If you need to get a handle on your finances and track your spending, each of these programs offer something for you. A budget can be as simple or complex as you need. You may want to simply track your total spending, or you may want to divide it into a range of categories. Some people like the envelope budgeting method, which allows you to set aside money each month for specific items or goals. Mvelopes is a good program that utilizes this method.

Goal-oriented Budgeting

If you’re budgeting because you want to save toward a goal, say a down payment on a home or for retirement, many of the programs offer tracking tools that let you set aside an amount each month and track your progress. Using personal finance programs to manage your budget can help you find areas you’re overspending in or ways you can cut back your spending to make your goals.

Tracking Investments

Not everyone invests money in the stock market, but if you do, you’ll need a program that can cover the full breadth of your financial picture. Many of the programs we tested integrate with your financial firm and can at least give you a top-level look at your portfolio. The best let you track your performance and compare your portfolio with the market. If investment tracking isn’t what you need, you can find a lower-cost program with the budgeting features you’re looking for.

Best Free Personal Finance Apps

Most of the personal finance programs we reviewed cost money to download or sign up for, and a few have monthly subscriptions. If you’re just starting to budget and track your finances, take a look at some of these free apps:

Mint: This is a free budgeting app developed by Intuit, the same company responsible for Quicken. Mint is free to download and use. Once you install it, you sync it to your bank and credit card accounts, and it pulls all that information into one main dashboard. Mint categorizes your transactions, so you can check your bank and credit card balances at a glance. It even goes a step beyond and lets you check your credit score and investment performances as well as your home’s value.

Mint automatically creates a budget for you, though you can adjust it depending on your needs. You can also set up alerts to tell you if you’ve gone beyond your budget or have a bill coming up. One drawback of using a free app like Mint is you get ads and promotional offers.

Clarity Money: This is a relatively new app, owned by Goldman Sachs. It's very similar to Mint in that it syncs to your bank accounts, tracks spending and sends alerts when you have a bill due. However, it stands out by monitoring your subscriptions to services and websites, and it can cancel them for you. Clarity Money gives you a good picture of your finances, but if you need more in-depth budgeting tools, it may not be as useful.

PocketGuard: This is a basic app that tracks your spending. It doesn’t have many additional features and may not be good for reconfiguring your entire budget, but it’s a useful way to see how much money you have on hand.