- Best Personal Accounting Software For Mac 2018 Update

- Accounting Software For Mac 2018

- Personal Accounting Software

- Best Free Mac Software 2018

- Best Personal Banking Software 2018

- Best Accounting Software For Mac

- Quicken

Personal finance software can help you master the basics, become more efficient at managing your money, and even help you discover ways to meet your long-term financial goals. Choosing the best personal finance software is based on your current financial needs.

Ten years ago, there were no solid money apps out there. If you wanted to track your money, you didn't have many options beyond websites like Google Finance.

I got my start tracking our budget and net worth with a spreadsheet. I would learn about Intuit's Quicken software but it felt silly to pay for software to help me save money. It wasn't until later that other options, like Mint, started to appear.

Best Personal Accounting Software For Mac 2018 Update

A great personal finance app can help you save more money and give you an instant snapshot of your financial situation in seconds. A lot of the problems we face when dealing with money have to do with decisions and information. We need to make a decision but we don't have enough information! To get it, we have to log into a lot of accounts, track a lot of data, and then analyze it before we make a decision. That's a tremendous amount of time that can be saved if you use a good personal finance app.

Today, you have free personal finance apps that are better than what you had to pay for years ago. Personal Capital, SigFig, Mint, YNAB, Mvelopes, … the list is long and distinguished.

Money apps have taken over and we all can benefit.

That's why earlier this year I polled the readers of Wallet Hacks for their “must-have, can't live without” money apps and here's what they said.

Best Money Management App – Personal Capital

A financial dashboard is a place where you can see everything involving your money in one place. Your assets, your liabilities, your net worth – all your financial accounts visible on one convenient page.

This is important because when that information is easily accessible, it's easily remembered and understood. We use it to pull in all of our data, though we ignore the credit card debt piece because we pay off our bills every month in full.

Accounting Software For Mac 2018

What's easier – logging into one account or logging into a dozen?

When it comes to a financial dashboard, the clear leader is Personal Capital. It has a rich suite of tools built around investments, with a nod towards expense tracking similar to Mint, so you can get a sense of where everything is at a moment's notice. If you're interested in a consultation with a financial advisor, they have that built in as well and it's something that helps them stand out from other similar services. It's how Personal Capital makes the money that supports the free tool.

This app is for you if: You want an instant snapshot of your finances, from your investments to your budget, in one place. Personal Capital is free.

Best Budgeting App – You Need a Budget

If you want to change your budget, You Need a Budget (YNAB) is one of the most powerful tools you can use because it does more than track your expenses – it actually helps you build and stick to a budget.

One of the biggest challenges in money management is in near-term planning. What are you going to do next week and next month?

Retirement can be decades away but you are spending money today and tomorrow. By getting the next month right, you go a long way towards getting your money situation under control.

YNAB has a four rule methodology that has worked well for its users.

- Give Every Dollar A Job

- Embrace Your True Expenses

- Roll With The Punches

- Age Your Money

Another reason why YNAB is powerful has to do with its educational tools and community. You will not find this with financial tools like Mint. There are no Whiteboard Wednesdays to help you understand your money a little better. This is what separates them from the pack in many ways.

This app is for you if: You want to transform your budget and get your spending in line with your financial goals. YNAB costs $6.99 a month after a 34 day trial.

It's this methodology around the tool that really makes it powerful.

Budgeting Runner Up – Mint

For tracking a budget, Mint is one of the most popular budgeting tools out there and we wanted to list them because they are free to use.

If you don't have sizable investments, Mint is a very powerful tool that is better for budgeting but less effective for investments. Personally, I felt like Mint was fantastic up to a point. Once you focus more on investing than budgeting, Personal Capital has far more tools to help you succeed.

This app is for you if: You want to know where your money is going each month without having to log into multiple accounts. Mint is free.

Best Support Tool – Tiller

Tiller is a service that will connect with your bank and credits card to pull daily transaction data into a sheet on Google Docs. No other service out there offers this. You can choose to start from half a dozen templates or roll your own, but Tiller will update it automatically from 100,000+ financial institutions.

NOTE: When we surveyed of our readers, the number one “app” was Microsoft Excel. Far and away the most popular application for anything – budgeting, financial dashboarding, net worth, whatever category you picked – it was Microsoft Excel.If you see a list of “best apps” and it doesn't list a spreadsheet like Microsoft Excel at #1 — they didn't actually survey. They made it up. 🙂

That being said – Microsoft Excel is all about finding a template and customizing something that fits your exact needs. It can be a lot of work but that hands-on interaction means you know the data is pristine. You can rely on tools like Tiller to pull the transaction data too so you get the automation (it works with Google Docs).

I use Microsoft Excel to track our net worth, with Personal Capital pulling the data.

The apps on this list are pre-built, faster to get into, and free. If you're starting from scratch, these apps will get you there faster but will not fit you like a glove. Excel is like a custom tailored suit, these are off the rack.

Tiller automates your custom spreadsheet so it fits you perfectly. Don't change the way you do things to match a tool, plug in Tiller and bring your spreadsheet into the 21st century.

Tiller is a monthly subscription but it won't inundate you with advertisements or pitch you on their financial planning services as an upsell. (to be fair, other companies need to do that because they are free – the bills have to be paid!)

You get the customization of a financial spreadsheet but the automation piece so you don't need to login to all of your accounts and update everything manually. Removing that hurdle makes money management that much easier. They offer a free 30-day trial.

This app is for you if: You love spreadsheets or have one you've tailored but need a tool to help you pull the data for you. Tiller costs $4.92 per month after a 30-day trial. (here's more about Tiller)

Robinhood is a stock brokerage that offers commission free trades through their app or web interface. They're like any other brokerage, they use Apex Clearing Corporation, are a member of FINRA, and have SIPC insurance for up to $500,000 like any other brokerage. There is no account minimum, no maintenance fee, and you can even trade crypto if you're so inclined.

They make money by offering a Robinhood Gold subscription service that gets you margin and after-hours trading. If you want to trade stocks, I find it difficult to argue against a Robinhood and their free trades.

For a limited time, you can get a free share of stock from Robinhood.

Personal Accounting Software

Best Microsaving App – Acorns

One of the newest innovations in personal finance apps is the idea of a microsavings app – where you can automatically save small amounts of money and have it invested in the market. The idea is that these apps will figure out how much they can transfer into an investment account without you, or your budget, realizing. It's less active than traditional saving but more effective if you're the type of person who doesn't actively manage your budget on a daily basis.

One of the best in class is Acorns, which doesn't rely on a black box “guessing” how much to save. When you make a purchase, the amount is rounded up and transferred. This predictability is often seen as a better process than some other apps, which “guess.” Guessing can be a little scary.

They also have a “Found Money” feature with some partners where if you make a purchase with a merchant, they may contribute a small bit to your Acorns account.

Here is our full review of Acorns.

Best Personal Finance Assistant – Trim

If robots can help you invest, perhaps they can help you do some of the more mundane jobs you don't want to?

That's the idea behind Trim, and a whole host of similar apps.

Trim is free to use and they can help you renegotiate your bills like with your cable provider, including Comcast, Time Warner, and Charter. They connect to your accounts, analyzes your recurring subscriptions, and identifies areas where you could be saving money. Cable is just the start, they will look at other subscriptions too including your car insurance.

The best part is that they handle the negotiations for you. No more calling Comcast and navigating the phone menu for ages – they do it for you. If you want to cancel, they'll do that for you too.

Here is our full review of Trim.

Summary

There are a lot of apps, many of them free but some of them paid, that will help you save time, save money, and save gray hairs.

Take advantage of them!

Other Posts You May Enjoy

Want to replace Quicken? We’ve got you covered.

As the granddaddy of personal finance software, Quicken was once the best money management tool on the market. Heck, it was practically the only tool on the market. Now? Not so much.

Though it was all the rage back in the day, little has been done over the last few years to improve Quicken. In fact, Intuit (famous for programs like Quickbooks and Turbo Tax) actually sold off their ownership rights to Quicken back in 2016. Since then, rumors have swirled that Quicken will actually shut down its program for good.

Luckily, Quicken is not your only choice for personal finance software. These days, there are a number of alternatives that can help you manage your money as well as Quicken ever did…and for less money. In fact, some of the best Quicken alternatives are actually free!

So, if you’re looking for a new program to manage your money, you’re in the right place. Check out our list of the top 10 Quicken alternatives below.

Table of Contents

- 16 Best Alternatives to Quicken

Our Top Picks

Personal Capital [Editor’s Choice] – Personal Capital is our Editor’s Choice for Quicken alternatives. This free software automatically tracks your savings, spending, investments, net worth, and more. It’s easy to use and the free price tag makes it an excellent replacement for Quicken. We’ve used it for years and think you’ll love it too! Read the review | Learn more

Tiller – If you’re looking for a budgeting tool that also runs some basic financial reports, Tiller is it. This program takes spreadsheet budgeting to the next level by helping you create a monthly budget and automatically tracking your results. When it comes to tax prep, Tiller can also run detailed reports on itemized deductions, your annual spend by category, and more. Start with one of their templates, customize it to meet your needs, or build your own. Get it free for the first month, then it’s only about $5 a month. Read the review | Learn more

16 Best Alternatives to Quicken

1. Personal Capital

Personal Capital is our favorite money management software of all time. We’ve used it personally for years, and we continue to be amazed by this powerful software.

What’s so great about Personal Capital? For starters, it’s free.

That’s pretty awesome considering they offer a comprehensive collection of money tools in one convenient place. Here, you can track your spending, net worth, and investments. You can also use it to check your investments for expensive fees and calculate whether you’re saving enough for retirement. These tools are all 100% free and at your disposal after a simple sign up process.

So, how does it work?

In short, Personal Capital synthesizes the data from all your accounts and delivers a complete financial picture that’s easy to understand.

Just link Personal Capital to your bank, credit, and investment accounts and let the program do the heavy lifting. It imports your transactions and calculates how your spending aligns with your budget.

Unlike some other alternatives to Quicken, Personal Capital is more than just budgets. And, since it is free, it makes a great compliment to some of the other programs as well.

Personal Capital also offers a powerful investment management tool. It tracks your asset allocation, monitors your investment performance, and analyzes your fees. It even takes your retirement goals into account and estimates your retirement income/expenditures based on your financial data. And, of course, Personal Capital also calculates the value of your assets relative to your debt (i.e. your net worth).

It might sound like a lot going on, but the app is incredibly user-friendly. A summary of your financial situation is available on the dashboard as soon as you open the app.

With all these money tools being offered for free, you might be wondering how Personal Capital actually makes money. Good question. They also offer fee-based wealth management services. Those are entirely optional, and you’re in no way obligated to subscribe. Tons of users enjoy the free suite of tools without using the wealth management services.

In my opinion, Personal Capital offers the best free money management software on the market. With a robust collection of money tools and a free price tag, this program blows many of the other alternatives to Quicken out of the water. Check out our complete Personal Capital review for more information!

2. Tiller

Tilleris a relative newcomer as a money management software program. This financial tracking tool is used in conjunction with Google Sheets (Gmail account required). So, if you’re into spreadsheets, Tiller might be just your thing.

Although it started out as solution for budgeting, Tiller has become more than just a budgeting program. Tiller can help you prepare for tax season by running detailed reports on your itemized deductions, annual spending by category, and more. For self-employed people and freelancers, they also offer a nifty tool that helps you determine your estimated quarterly taxes. They also provide a debt snowball worksheet and some simple net worth tracking.

To get started, simply link your bank accounts to the program. Then, Tiller will automatically download your financial transactions into Google Sheets on a daily basis.

From there, you’re free to take advantage of Tiller’s limitless customization options. They provide multiple budgeting templates you can use, but you can also create a brand new spreadsheet unique to your preferences.

Every day, Tiller emails you a summary of your financial activity so you always know exactly what’s happening with your money.

You can try Tiller free for 30 days to see if it meets your needs. After that, it’s about $5 a month, or free for a year if you’re a student.

3. YNAB

You Need a Budget (YNAB) is an excellent choice for anyone who wants an easy to use and effective budgeting app.

YNAB doesn’t offer a whole suite of money tools like Personal Capital. It focuses on two things: building a realistic budget and tracking your spending. And that’s ok, because it does them both very well.

I say a realistic budget because YNAB’s philosophy is that a budget is fluid and should be adjusted frequently in response to what’s going on in our lives. That’s why YNAB makes it so easy to move money between spending categories to keep your budget balanced.

For example, if you’ve budgeted $300 for groceries, but your transactions indicate that you’ve spent $340, YNAB will notify you that you’ve overspent and prompt you to deduct that $40 from another category. This system is especially useful if your goal is to maintain a zero-sum budget.

When you use YNAB, you have two choices. You can either automatically import your transactions by connecting to your bank and credit providers, or you can enter your transactions manually. Obviously, automating things is easier, but some may appreciate the option to do things the old-fashioned way.

YNAB offers a free 34-day trial, so you can try a full month of budgeting with no commitment. After that, the cost is $6.99 a month, billed annually. That means once a year, you’ll pay $83.88 to use the app/software. Unless you’re a student – then you can enjoy 12 months for free – which is a pretty cool benefit.

Also cool is that YNAB offers a 100% money-back guarantee. So, if you buy the app and decide it’s not helping you take control of your finances, YNAB will give you a full refund. Can’t argue with that!

4. Mint

Mint is a comprehensive financial tool that Quicken enthusiasts will probably appreciate. In fact, Intuit acquired Mint in 2010 shortly before they dropped Quicken from their suite of financial tools. Stew on that for a minute and think about which program Intuit thinks is better 🙂

Like with some of the other Quicken alternatives, when you link your financial accounts to Mint, you have access to your whole financial picture in one place.

As we mention in our full Mint review, you can build a budget, track your spending, monitor your investments, and manage your bills. The bills feature is really nice for people who haven’t automated their bill payments and want the ease of managing them on one platform.

Mint also lets you check your credit score and explains how it’s calculated. I think this is pretty neat because a lot of people don’t know their credit score or understand how these scores work.

With all that under one roof, you might be surprised to learn that Mint is free. Hey, we’ll take it.

5. PocketSmith

If you want to get a better handle on your money, PocketSmith might be for you. Like several of the best alternatives to Quicken, this program provides a strong option for budgeting. Where it really shines, however, is with its financial forecasting.

Instead of simply tracking what you’ve already spent, PocketSmith also helps you see what the future holds for your money. The “budget calendar” provides a daily look at your future income and expenses, all on an easy-to-read calendar so you can plan appropriately. Using your current info, you can even project your bank account balances as far out as 30 years into the future.

Our favorite feature is the “what if” scenarios. This feature allows you to test different spending and saving decisions and see how they affect your future financial growth. Wondering how reducing your grocery spending will affect your savings rate? Want to take a $2,000 vacation next summer? Use the “what if” feature to understand both the short-term and long-term consequences.

Best Free Mac Software 2018

As with most Quicken alternatives, PocketSmith utilizes live bank feeds to update your transactions automatically. Over 10,000 different financial institutions are supported, so it’s pretty likely that you’ll be able to connect your accounts.

The basic functions of PocketSmith can be used for free, however you are limited to connecting just 2 accounts and 6-months of projections. The Premium version runs $9.95 per month and comes with 10 accounts and 10 years of projections. Unlimited accounts and 30 years of projections are available with the “Super” account which runs $19.95 per month.

6. CountAbout

CountAbout web-based personal finance software is another contender for the best Quicken alternatives. This program actually supports importing data from both Quicken and Mint, which is nice.

When you use CountAbout on a computer, there’s no app to install; you simply log in to their website. They do offer a mobile app for iOS and Android, but not all the features are available through the app.

Use CountAbout to create a customizable budget; then, sync it to your bank account to automatically import your transactions and track your spending. You can get a snapshot of your financial activity with widgets, or general full financial reports.

CountAbout offers two membership options: basic for $9.99 a year or premium for $39.99 a year. The only difference between the two is that the basic membership does not support syncing with online bank accounts. That means if you opt for the basic membership, your transactions will not be automatically downloaded. Your options are to enter transactions manually or import QIF files from your bank if they make those available.

If you’d like to try CountAbout before committing, you can get their 15-day free premium trial.

7. Moneydance

Moneydance is another viable personal finance software alternative to Quicken. In fact, if you currently have Quicken data, you can import it into Moneydance. It’s available as a desktop app for all the major operating systems and as a mobile app.

Moneydance’s interface kind of resembles a check register, where you see a record of all your transactions. Those transactions can be imported automatically by syncing with your online banking, or you can enter them manually. If you choose the automated route, you can also manage bill payments through Moneydance.

Of course, it wouldn’t be personal finance software without the ability to create a budget. Moneydance lets you create spending categories and track your expenditures. If you’re a visual person, you’ll appreciate the interactive graphing tool. You can also use Moneydance to track your investments and monitor stock performance.

If you’re technologically inclined (i.e. a tech nerd), you can actually develop extensions for Moneydance using an Extension Developer Kit they offer as a free download. But I won’t get into that today!

You can try Moneydance using their free trial, which works a bit differently than the other trials we’ve talked about. There’s no time limit on their trial, but you’re limited to 100 manually entered transactions. Still, that’s enough to decide if Moneydance is for you. After that, you can buy the full program for a one-time fee of $49.99. They also offer a 90-day money back guarantee when you purchase from their website.

8. Banktivity

Banktivityis a personal money manager made for Mac users. The newest version, Banktivity 7, is designed specifically for MacOS Sierra. And – like Moneydance – when you turn to Banktivity as a Quicken replacement, you can import your data for a seamless transition.

With Banktivity, you’ll sync your bank accounts and use it to build budgets, track your spending, pay your bills, and monitor your investments.

They also offer some really cool reporting options. For example, you can generate reports based on category spending or spending at a given merchant. So, if you want to track how much you spend on eating out, you can easily generate a report showing all your spending in that category over a given time frame. Or, if you want to get even more specific, you can easily pull up how much you spent on McDonald’s in the past two weeks.

The “Find” feature in Banktivity is kind of like Mac’s spotlight – it lets you search all your transactions to find the one you’re looking for. This can be a great time saver when you’re trying to quickly check something specific.

Banktivity offers a free 30-day trial, no credit card required. After that, you can purchase the desktop app for a one-time fee of $69.99. You can then download the app on iPhone and iPad and sync across your devices.

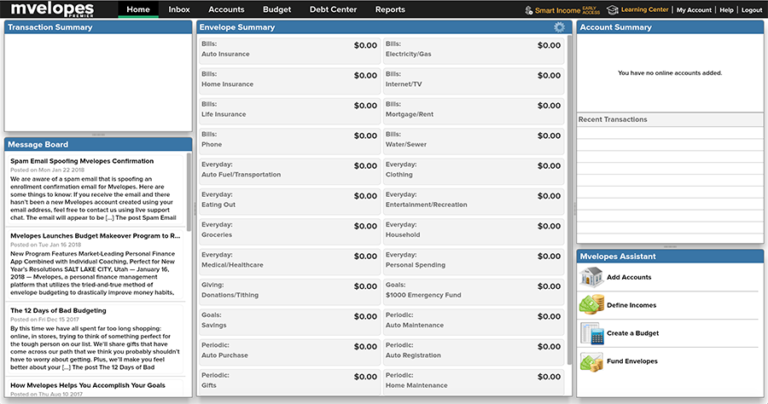

9. GoodBudget

GoodBudget is a simple budgeting app that helps you plan and track your spending through a digital version of the envelope method.

If you’re unfamiliar with the envelope method, this is a style of budgeting where you use an envelope for each spending category. First, you’ll plan how much you’ll spend on each category (usually throughout the month). Then, you allocate cash for those expenses in each category’s designated envelope.

Throughout the month, you’ll take money from a designated envelope each time you need to spend in that category. If you run out of money in an envelope, you can’t spend any more on that category… unless you borrow the money from another envelope (which will reduce your spending power in that category).

The free version of GoodBudget gives you twenty envelopes and allows you to download transactions from one bank account. You can also sync across two devices – which is great for using it on desktop and mobile. You can also use one sync to share a budget with your partner.

GoodBudget Plus costs $6 a month or $50 a year. This gives you access to unlimited envelopes and bank account syncing. You can also use the app on five different devices.

Since you’re likely to have more than one account and may both want access on multiple devices, GoodBudget Plus is probably more practical for a couple who shares a budget. That being said, it’s great that this software also has a free option.

10. Dollarbird

Dollarbird is another simple, no-frills budgeting app that makes for a good alternative to Quicken. This app is unique in that it’s calendar-based rather than category-based. What this means is that Dollarbird focuses on tracking your income and spending by day, rather than by category.

So, when you open the app, you’ll see a calendar. From there, you have the option of adding transactions (income or spending) for each day. Although you do categorize your transactions, the app displays your net spending per day rather than a running category total.

At this time, Dollarbird does not support syncing with your online accounts. This means all your transactions must be entered manually. However, you can schedule recurring transactions so you’re not constantly required to enter your regular fixed expenses. If you’re paid a regular salary, you can do the same with your paychecks.

The free version of Dollarbird gives you access to one calendar – perfect if you’re doing a simple solo budget.

The paid Pro version allows up to 20 calendars and can be accessed by three people. Again, the paid option might be more practical for couples. You can opt to pay $3.99 monthly or $39.99 for the year.

11. Everydollar

Next on our list of Quicken alternatives, we have Everydollar. If you’re a Dave Ramsey fan, you may want to give his budgeting tool a try.

Everydollar lets you budget your income into customizable spending categories, then enter your transactions and track your spending. The free version doesn’t link to your online accounts, so you enter your transactions manually. (If you want to automatically sync to your online accounts, you’ll need the paid version.) That’s not a deal breaker, but one thing I’ve noticed is that the app doesn’t seem to remember the category associated with a payee that’s previously been entered. Adding that would be a nice touch.

This is a super simple budgeting app that should meet the needs of someone who wants to get started with planning a budget and tracking their spending. It’s free, so there’s no risk involved in trying it out for a few months to see what you think.

12. PocketGuard

If simple smartphone apps are more your thing, PocketGuard deserves your consideration.

PocketGuard helps you budget your money, track your spending, and lower your bills. Better yet, it is available for both iOS and Android devices.

Best Personal Banking Software 2018

To get started, simply connect your credit cards, bank accounts, investments, and loans to the app. Your info will sync to the app and update automatically as transactions happen.

Although it’s not as powerful as the best Quicken alternatives, it can certainly help you keep an eye on your finances. Like some of the other programs, this app helps you see the balance of your connected accounts all in one place. It can also help you track and categorize your spending, set monthly income and spending goals, and provide tips on where you can save even more. The “in my pocket” feature even shows the amount of money you’ve got available to spend after accounting for all of your bills and savings goals.

PocketGuard’s main features are free. It’s worth noting, however, that they also offer a paid version called PocketGuard Plus. The upgrade offers significantly more customization (including custom categories, cash transactions, etc.) and costs $3.99/month or $34.99 if you pay annually.

13. MoneyWiz

MoneyWiz is another alternative to Quicken that works with Apple, Android, and Windows devices.

With this app, you can easily sync all of your financial data into one place. It also boasts a live syncing feature which allows you to sync data between devices in real-time.

Using MoneyWiz for budgeting is also a breeze. The app allows you to create different budgeting categories which you can set up as a one time or recurring category. Balances can be rolled over from one period to the next, and the program will even monitor your accounts for transactions – automatically updating the relevant information as you go. You can also transfer money between categories, similar to the “envelope” method.

In addition to the automatic syncing functions on the premium version of the app, MoneyWiz also allows you to enter your transactions manually. It is also capable of creating multiple reports and graphs, including custom financial reports.

So, if you’re looking to replace Quicken, MoneyWiz may be worth a try. While there is a stripped down version that’s free, you can get all the functionality by purchasing the premium version for just $4.99 a month or $49.99 per year.

14. Status Money

Are you competitive about your finances? There’s an app for that.

Status is a free program that allows you to compare your financial situation with your peers. Simply connect your accounts and start comparing right away. Then, use those comparisons as motivation to improve your own financial situation!

Of course, Status is about more than just comparing yourself to others. With Status, you can track your net worth, create spending goals, and monitor your credit. The program also analyzes your saving and spending by category, offering suggestions to improve your situation along the way.

Although Status is not nearly as robust as many of the other options, it is free to use. (It is ad supported, so keep that in mind when considering their suggestions.) So, while it may not be the perfect Quicken replacement, it won’t cost anything for you to test it out.

15. Wally

Wally is another personal finance app available for use on your smartphone. This app focuses entirely on budgeting and tracking your expenses. So, if you’re somebody who needs help with those two things (and who doesn’t?), Wally may be for you!

Best Accounting Software For Mac

Although the app is attractive, it isn’t very complex. Unlike almost every other program on this list, with Wally, you won’t connect your accounts. For those who are a little skittish about cloud-based apps, this may actually be seen as a plus.

Effectively, Wally is like using a paper budget…except it’s on your smartphone. You’ll have to manually enter your income and transactions, although you do have the ability to create recurring expenses for bills that stay the same every month.

Even though it lacks automation, Wally does a good job of doing what it sets out to do – help people manage their monthly budgets. Once you set it up, you’ll be able to quickly compare your monthly income to your expenses, helping you to get a firmer grasp on your finances.

Wally was originally available just for iPhones, but they recently unveiled a new version for Android. According to their website, the app is (and always will be) free. There are plans to add some paid features, but we’ll have to wait and see what those are when they are rolled out in the future.

16. GnuCash

Quicken

GnuCash is a free open-source financial management software that runs on some Windows and Apple operating systems.

The app uses the double-entry accounting method to help you keep track of your finances. Business owners should already be familiar with this concept as it is the preferred method used for balancing books and keeping accurate financial records for companies.

With that said, the app can help with your personal finances as well. Through GnuCash, you can track your bank accounts, income, expenses, and investments. If you’re planning to replace Quicken, you can input your information directly from your old software. GnuCash is also capable of running a variety of financial reports for those who need them.

GnuCash is typically better for those who have a business and isn’t a perfect fit for most people’s personal finances. However, it is free, so it may be worth a try.

Quicken Alternatives: Final Thoughts

With Quicken no longer the only financial tracking game in town, there are plenty of options to choose from. Whether you’re looking for a simple budgeting program or a complete personal finance software package, there’s enough variety on this list to suit almost any need.

Although everybody has their preferences (us included), ultimately, the best financial tools are ones you’ll use consistently. So why wait? Use one of the links above to download a free app or start a free trial to find out what program works for you.

How many of these money management tools have you tried? Which is your favorite? Let us know in the comments!